by:

There have been a lot of shifts in the housing market recently. Mortgage rates rose dramatically last year, impacting many people’s ability to buy a home. And after several years of rapid price appreciation, home prices finally peaked last summer. These changes led to a rise in headlines saying prices would end up crashing.

Even though we’re no longer seeing the buyer frenzy that drove home values up during the pandemic, prices have been relatively flat at the national level. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), doesn’t expect that to change:

“[H]ome prices will be steady in most parts of the country with a minor change in the national median home price.”

You might think sellers would have to lower prices to attract buyers in today’s market, and that’s part of why some may have been waiting for prices to come crashing down. But there’s another factor at play – low inventory. And according to Yun, that’s limiting just how low prices will go:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

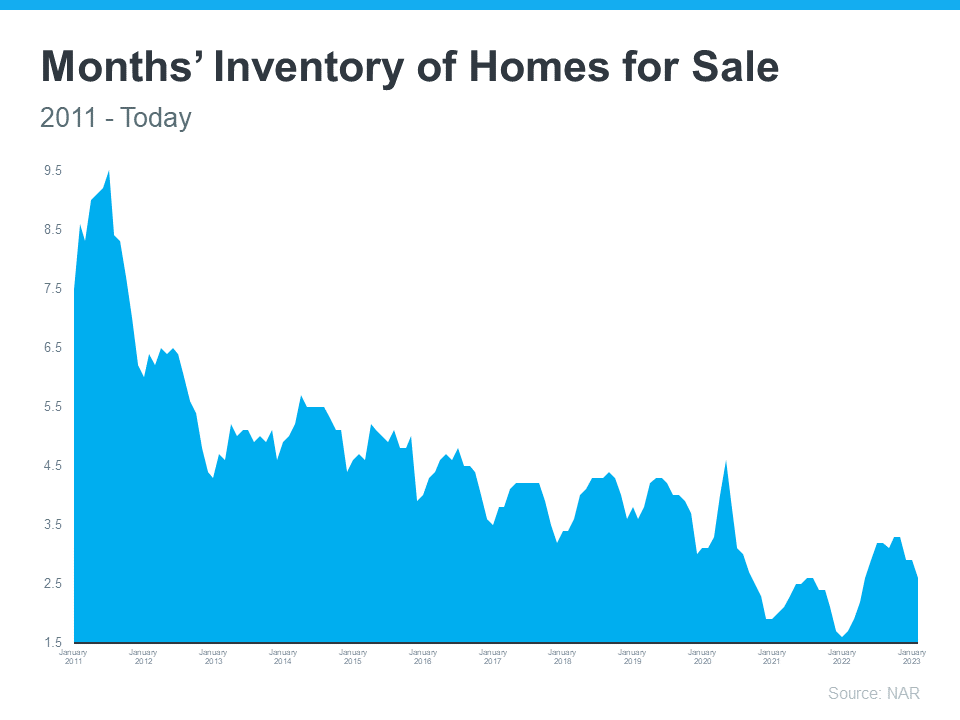

As you can see in the graph below, we’ve been at or near record-low inventory levels for a few years now.

That lack of available homes on the market is putting upward pressure on prices. Bankrate puts it like this:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

If more homes don’t come to the market, a lack of supply will keep prices from crashing, and, according to industry expert Rick Sharga, inventory isn’t likely to rise significantly this year:

“I believe that we’re likely to see low inventory continue to vex the housing market throughout 2023.”

Sellers are under no pressure to move since they have plenty of equity right now. That equity acts as a cushion for homeowners, lowering the chances of distressed sales like foreclosures and short sales. And with many homeowners locked into low mortgage rates, that equity cushion isn’t going anywhere soon.

With so few homes available for sale today, it’s important to work with a trusted real estate agent who understands your local area and can navigate the current market volatility.

Bottom Line

A lot of people expected prices would crash this year thanks to low buyer demand, but that isn’t happening. Why? There aren’t enough homes for sale. If you’re thinking about moving this spring, let’s connect.

*The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Primary Residential Mortgage, Inc and Keeping Current Matters, Inc. do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Primary Residential Mortgage, Inc and Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Sources:

Rothstein, Robin. “Housing Market Predictions for 2023: Are Home Prices Finally Becoming Affordable?” Forbes Advisor, edited by Chris Jennings, 28 Dec. 2021, www.forbes.com/advisor/mortgages/real-estate/housing-market-predictions.

Ostrowski, Jeff. “Is The Housing Market About to Crash? Here’s What Experts Say.” Bankrate, edited by Michelle Petry, 13 Mar. 2023, www.bankrate.com/real-estate/is-the-housing-market-about-to-crash.

-(2).png?sfvrsn=963aebdb_0)