What Every Contractor Should Know About Renovation Loans

If you are a contractor working on a project that is being financed by a renovation loan, there are three (3) things you should know:

1. All contractors must undergo an “acceptance” process

2. There are bid requirements for these loans

3. A draw process must be followed to get paid

ACCEPTANCE PROCESS:

To begin the acceptance process, you must complete an online contractor questionnaire form at https://www.primeres.com/renovations/contractors/contractor-registration, and email supporting documents (e.g. business license, insurance(s), identification, signed W-9) to [email protected] or fax them to (443) 703-2351.

BID REQUIREMENTS:

All bids submitted on renovation loans must meet the following requirements:

1. Bid must be submitted on the contractor’s letterhead (i.e. name of company, name of primary contact, business address, telephone number, email address, and license # of the contractor)

2. Borrowers name and subject property address must be present (Cannot be issued to the Real Estate Agent or Loan Officer)

3. Must be a true “Bid”, not an “Estimate”

4. Repairs must be explained in detail so while reading we can picture the work being done

5. Material and Labor must be broken down separately for each repair, then totaled at the bottom of bid

EXAMPLE: Install hand rail for stairs leading to the basement.

Material $150 Labor $75 Total $225

6. Blend Taxes, Overhead, and Profit into each line item. Taxes, Overhead and Profit are not allowed as separate line items

7. Specify whether or not permits are required (attached permit cert form, MUST BE FILLED OUT)(NO EXCEPTIONS). If required, permit cost must be on separate invoice or separated from “total repair cost” on the bid)

8. All bids must be signed by contractor and borrower (ATTACHED SAMPLE BID FOR REFERENCE)

DRAW PROCESS:

All draws must be submitted by the contractor online, AFTER CLOSING. Once the loan closes, you will be given instructions who your contact is to submit draws: Certain steps must take place before a draw request is honored. For example, an inspection must be performed to document work is being done or has been completed satisfactorily. Title updates, executed draw authorizations and lien waivers, invoices, and other forms or documents may also be required. Be sure to inquire about the process ahead of time, so you will understand what steps need to be taken and how it may take to process your draw request.

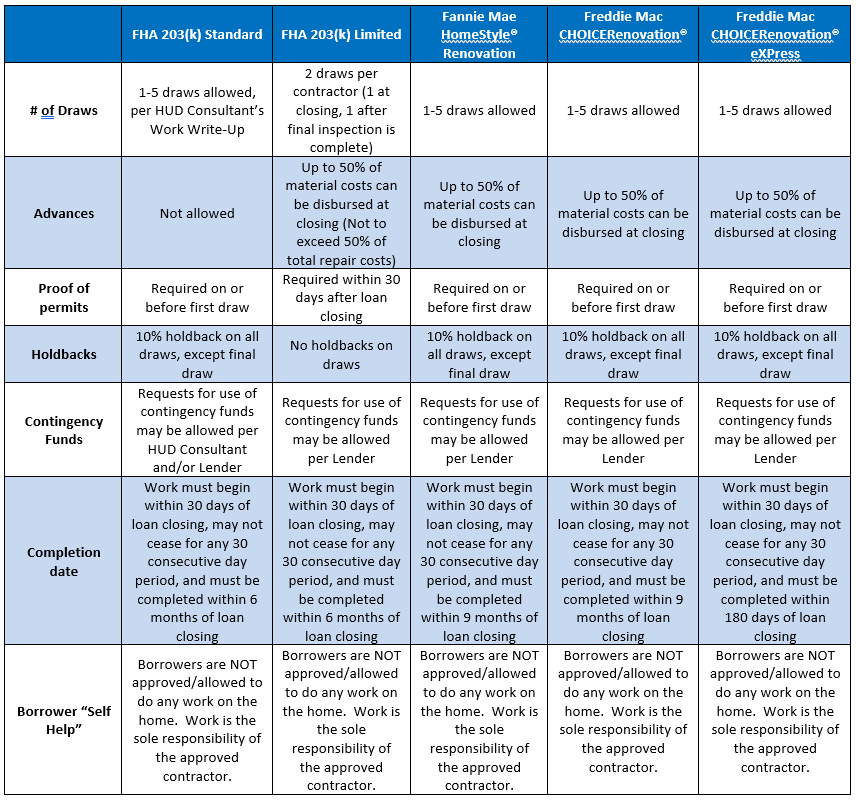

Draw guidelines vary depending on loan type, and are outlined below.