by:

If you’re thinking about buying a home, you might be focusing on previously owned ones. But with so few houses for sale today, it makes sense to consider all your options, and that includes a home that’s newly built.

The Number of Newly Built Homes Is on the Rise

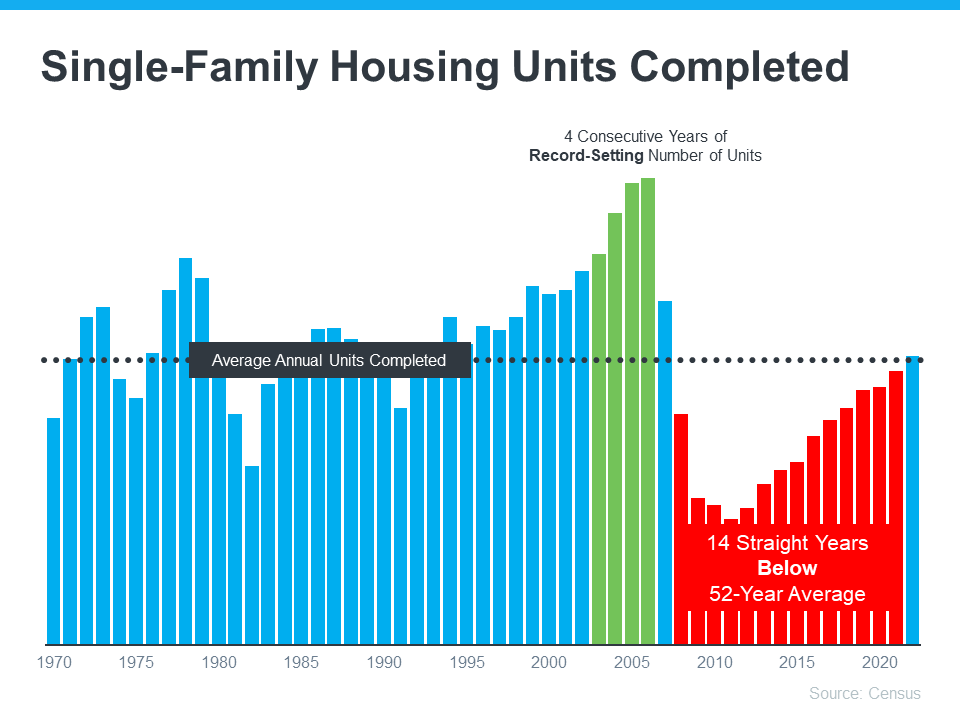

While there are more houses for sale right now than there were at this time last year, there’s still a historically low number of homes available on the market. One reason for that is years of underbuilding—meaning there haven’t been enough new homes built to keep up with demand.

The graph above shows how low the production of newly constructed homes has been over the past 14 years. But it also shows another important trend: the number of new homes being built each year is on the rise. As Mark Fleming, Chief Economist at First American, shares, that’s good news for buyers:

“While existing-home inventory remains limited, the silver lining for home buyers is that new-home inventory is on the rise, and a new home at the right price is a pretty good substitute.”

Builder Incentives Can Provide a Boost

While there a growing number of new homes for sale, builders are slowing that pace until they sell more of their current inventory. According to Logan Mohtashami, Lead Analyst at HousingWire:

“The builders have to work off the backlog of homes, but instead of 3%-4% mortgage rates, they’re dealing with 6% plus mortgage rates, which means they have to provide many incentives to make sure those homes sell.”

Many builders are now offering incentives to help buyers purchase these homes. Fleming also explains:

“The National Association of Home Builders reported that nearly two-thirds of builders were offering incentives, including mortgage rate buydowns, paying points for buyers and price reductions, which could entice potential home buyers.”

A builder who’s willing to pay to reduce your mortgage rate could be a game changer. Ksenia Potapov, Economist at First American, puts it this way:

“A one percentage-point decline in mortgage rates has the same impact on affordability as an 11 percent decline in house prices.”

Should You Buy a Brand-New Home?

The best way to decide what type of home to buy is to work with a trusted real estate professional who can help you weigh the pros and cons of each option. They know which homes are available in your local market, and which builders might be offering incentives that make sense for you.

Bottom Line

Even though there aren’t a lot of homes for sale today, new home inventory is on the rise, and many builders are offering incentives. Let’s connect so I can help you weigh the pros and cons of shopping for a new home versus an existing one.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Primary Residential Mortgage, Inc and Keeping Current Matters, Inc. do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Primary Residential Mortgage, Inc and Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Sources:

“United States Census Bureau.” Historical Time Series, 30 Nov. 2022, www.census.gov/construction/nrc/data/series.html.

Fleming, Mark. “Why Housing Market Potential Increased for the Second Straight Month.” First American, 20 Jan. 2023, blog.firstam.com/economics/why-housing-market-potential-increased-for-the-second-straight-month.

Mohtashami, Logan. “Homebuilders Still Need Lower Mortgage Rates.” HousingWire, 27 Jan. 2023, www.housingwire.com/articles/homebuilders-still-need-lower-mortgage-rates.

Potapov, Ksenia. “Why Mortgage Rates Hold the Key to Improved Affordability in 2023.” First American, 3 Feb. 2023, blog.firstam.com/economics/why-mortgage-rates-hold-the-key-to-improved-affordability-in-2023.

-(2).png?sfvrsn=963aebdb_0)