by:

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

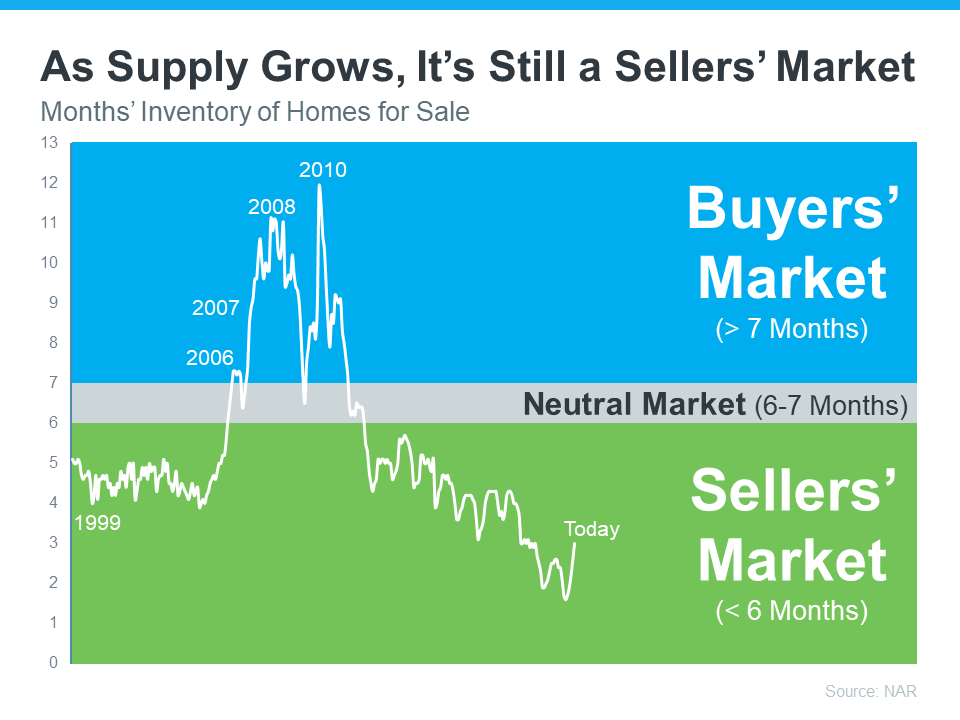

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

*The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Primary Residential Mortgage, Inc and Keeping Current Matters, Inc. do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Primary Residential Mortgage, Inc and Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Sources:

“Existing-Home Sales.” www.nar.realtor, Sept. 2022, www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales.

Moore, Miriam. “Council Post: The Power to Drive Change: How Millennials Are Affecting the Housing Market.” Forbes, 25 May 2022, www.forbes.com/sites/forbesbusinesscouncil/2022/05/25/the-power-to-drive-change-how-millennials-are-affecting-the-housing-market.

Fleming, Mark. “What’s the Outlook for Housing Market Potential for the Rest of 2022?” First American, 18 Oct. 2022, blog.firstam.com/economics/whats-the-outlook-for-housing-market-potential-for-the-rest-of-2022.

-(2).png?sfvrsn=963aebdb_0)

.png?sfvrsn=2fcea3bf_0)

.png?sfvrsn=76f6ccf3_0)

.png?sfvrsn=8d78ea3e_0)