by:

Today’s cooling housing market, the rise in mortgage rates, and mounting economic concerns have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to factor the long-term benefits of homeownership into your decision.

Consider this: if you know people who bought a home 5, 10, or even 30 years ago, you’re probably going to have a hard time finding someone who regrets their decision. Why is that? The reason is tied to how you gain equity and wealth as home values grow with time.

The National Association of Realtors (NAR) explains:

“Home equity gains are built up through price appreciation and by paying off the mortgage through principal payments.”

Here’s a look at how just the home price appreciation piece can really add up over the years.

Home Price Growth Over Time

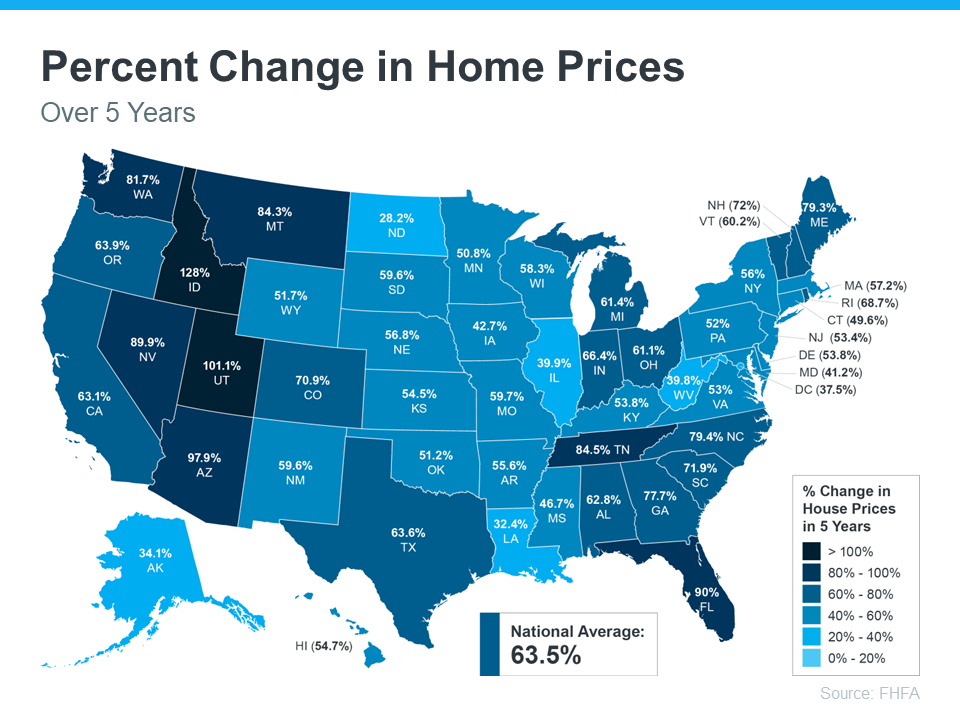

Even though home price appreciation has moderated this year, home values have still increased significantly in recent years. The map below uses data from the Federal Housing Finance Agency (FHFA) to show just how noteworthy those gains have been over the last five years.

If you look at the percent change in home prices, you can see home prices grew on average by almost 64% nationwide over that period.

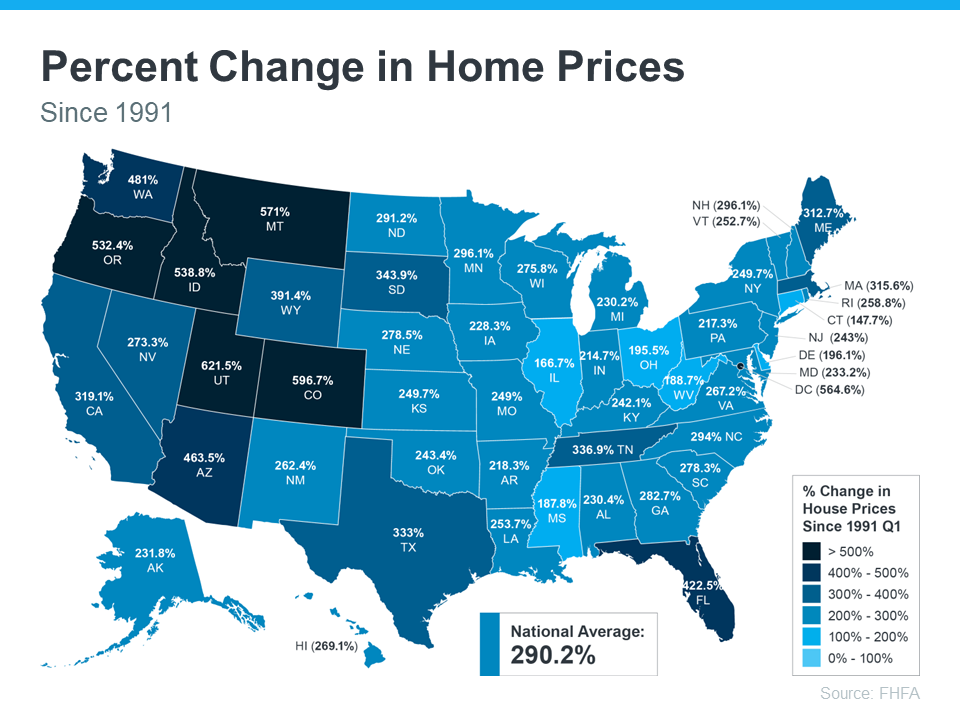

That means a home’s value can increase substantially in a short time. And if you expand that time frame even more, the benefit of homeownership and the drastic gains you stand to make become even clearer (see map below):

The second map shows, nationwide, home prices appreciated by an average of over 290% over roughly a thirty-year span.

While home price growth varies by state and local area, the nationwide average tells you the typical homeowner who bought a house thirty years ago saw their home almost triple in value over that time. This is why homeowners who bought their homes years ago are still happy with their decision.

Even if home price appreciation eases as the market cools this year, experts say home prices are still expected to appreciate nationally in 2023. That means, in most markets, your home should grow in value over the next year even if the pace is slower than it was during the peak market frenzy when prices skyrocketed.

The alternative to buying a home is renting, and rental prices have been climbing for decades. So why rent and fight annual lease hikes for no long-term financial benefit? Instead, consider buying a home. It’s an investment in your future that could set you up for long-term gains.

Bottom Line

Don’t let the shifting market delay your dreams. Data shows home values typically appreciate over time, and that gives your net worth a nice boost. If you’re ready to start your journey to homeownership, let’s connect today.

*The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Primary Residential Mortgage, Inc and Keeping Current Matters, Inc. do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Primary Residential Mortgage, Inc and Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

“FHFA HPI Summary Tables | Federal Housing Finance Agency.” FHFA HPI Summary Tables | Federal Housing Finance Agency, www.fhfa.gov/DataTools/Tools/Pages/House-Price-Index-(HPI).aspx. Accessed 5 Oct. 2022.

“Metro Area Housing Wealth Gains.” www.nar.realtor, www.nar.realtor/research-and-statistics/research-reports/metro-area-housing-wealth-gains. Accessed 5 Oct. 2022.

-(2).png?sfvrsn=963aebdb_0)

.png?sfvrsn=2fcea3bf_0)

.png?sfvrsn=76f6ccf3_0)

.png?sfvrsn=8d78ea3e_0)