What is the metroDPA Social Equity Program?

The metroDPA Social Equity Program offers potential homeowners $15,000 or $25,000 based on their income level and approval by the Department of Housing Stability.* The program that aims to increase homeownership in communities of color, and targets people who lived in or are descendants of families that lived in Denver’s redlined neighborhoods from 1938-2000.

metroDPA Social Equity Program Eligibility:

- Household income limits of $176,700/year

- Minimum credit score of 640

- Up to 5% in down payment assistance with no interest*

- Forgivable loan - don't have to pay back in the homeowner stays in the home for more than 3 years

Applicants must do the following to use the metroDPA Social Equity program:

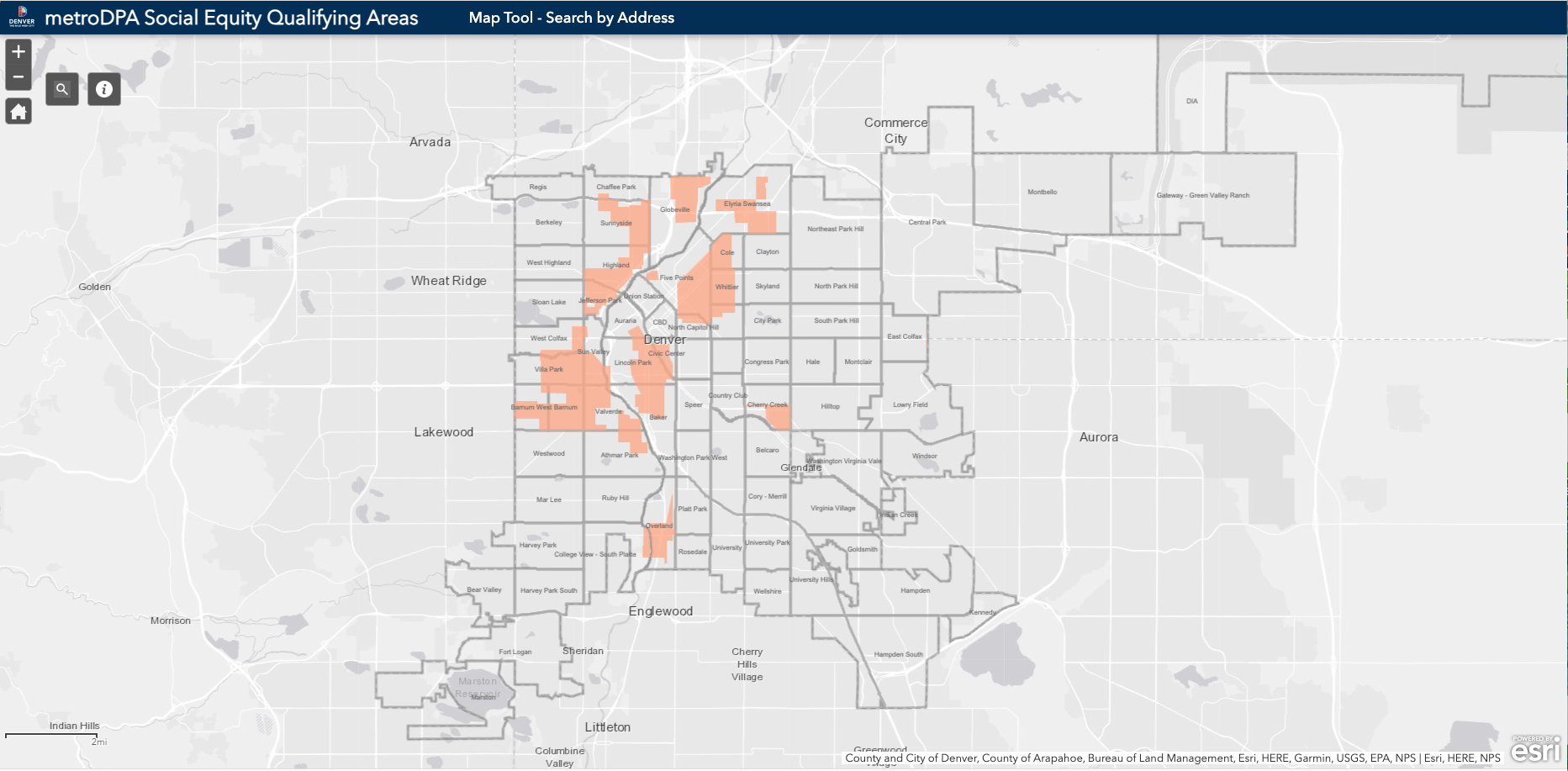

- Find the location on the redlined mapping tool to identify it as an eligible property

- Complete a form and provide the necessary documentation to prove eligibility

- If eligible, an approval number will be emailed to you

- Meet credit and income qualifications to qualify for a metroDPA home loan

- Income level determines the amount of assistance

Social Equity Program Application Form

*First lien interest rates may be higher when using a DPA second.

-(1).png?sfvrsn=bb549c79_0)